Key Takeaway: The cybersecurity sector broke records in 2025, with eight mega-deals exceeding $1 billion and over 420 total M&A transactions valued at $84 billion, reshaping how enterprises buy security.

A Watershed Moment for Cybersecurity M&A

The cybersecurity industry just closed the books on 2025, and the numbers tell a compelling story: the sector witnessed a seismic shift in how companies buy, build, and consolidate security solutions. With more than 420 merger and acquisition deals announced throughout the year and total disclosed transaction values exceeding $84 billion, the cybersecurity market has reached a critical inflection point.

This figure marks a decisive comeback from 2024’s more cautious dealmaking environment. According to industry analysis, 2025 M&A activity in cybersecurity surpassed 2024 volumes by more than 10 percent and came close to equaling the sector record of approximately $75 billion set in 2021. The rebound signals that despite persistent geopolitical tensions, trade friction, and business uncertainty, corporate dealmakers worldwide have regained confidence in cybersecurity as a mission-critical investment.

The Mega-Deal Phenomenon: Eight Transactions Above $1 Billion

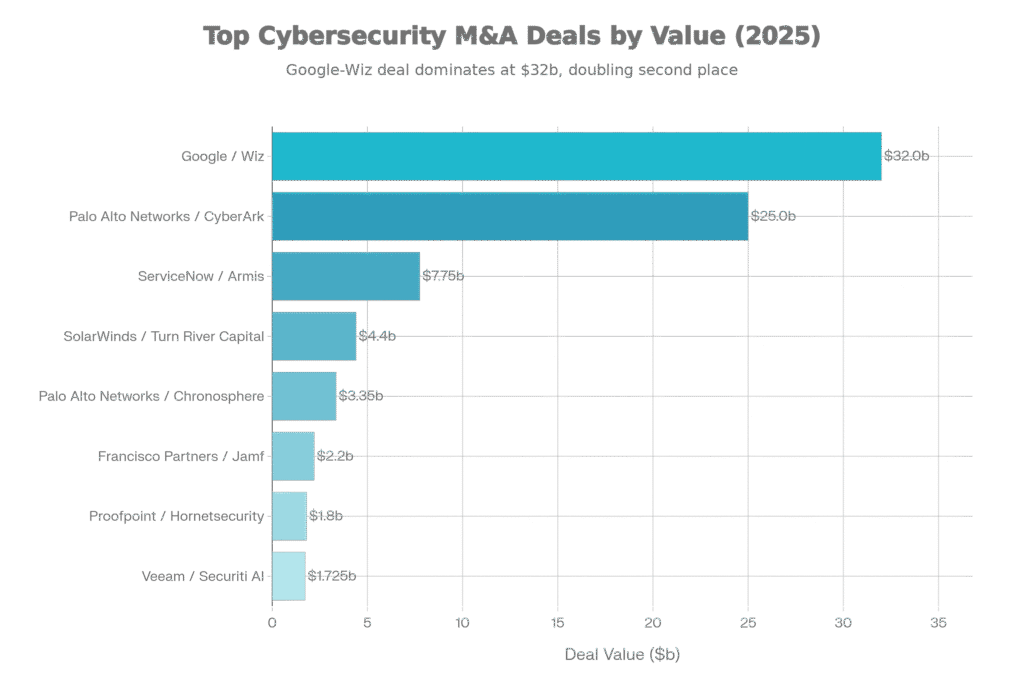

What sets 2025 apart from previous years is the emergence of eight transformational acquisitions, each exceeding the $1 billion threshold. Together, these mega-deals accounted for nearly $75 billion in transaction value—nearly 90 percent of the year’s total disclosed value. This concentration of capital in large transactions fundamentally reshapes the competitive landscape and signals a clear market message: buyers want integrated solutions, not point products.

Google’s record-breaking $32 billion all-cash acquisition of Wiz Security dominates the 2025 headlines. Announced in March and cleared by U.S. regulators in November, the deal represents the largest cybersecurity acquisition ever recorded and Google Cloud’s most aggressive bet on cloud and AI security. Wiz, which achieved $500 million in annual recurring revenue (ARR) in 2024 and was projected to surpass $1 billion in ARR in 2025, offers something Google lacked: rapid visibility into multi-cloud environments spanning AWS, Azure, and Google Cloud Platform.

Palo Alto Networks’ $25 billion acquisition of CyberArk, announced in July, represents the company’s deliberate entry into a category it had strategically avoided: identity security. The deal underscores a profound market shift: as enterprises accelerate AI agent deployment, controlling and protecting privileged identities—both human and machine—has become the “control plane” for enterprise security. CyberArk’s technology for managing identities in AI-driven environments represents exactly the capability Palo Alto needed to compete on a comprehensive platform basis.

ServiceNow made two major moves: a $7.75 billion acquisition of Armis Security (asset visibility) and a $1 billion acquisition of Veza (identity governance). Together, these transactions position ServiceNow as an increasingly comprehensive platform for IT, OT, IoT, and identity governance—precisely what enterprises demand from modern security platforms.

Additional major deals that shaped 2025 included:

- SolarWinds taken private by Turn/River Capital for $4.4 billion

- Jamf acquired by Francisco Partners for $2.2 billion

- Hornetsecurity purchased by Proofpoint for $1.8 billion

- Securiti AI bought by Veeam for $1.725 billion

- Chronosphere acquired by Palo Alto Networks for $3.35 billion

Why Vendors Are Consolidating

The mega-deal phenomenon doesn’t exist in a vacuum. It reflects a fundamental shift in enterprise security buying behavior and corporate strategy. Here’s what’s driving the consolidation wave:

Vendor Sprawl Fatigue

CISOs managing security environments filled with 45 to 83 separate security tools report unsustainable complexity. Research indicates that 50 percent of CISOs want to consolidate their security tools, while 75 percent of organizations are actively reducing their number of security vendors. The rationale is simple: too many tools create visibility gaps, complicate incident response, increase maintenance costs, and multiply integration burden.

Gartner predicts that by 2026, 70 percent of organizations will consolidate cloud-native security vendors to a maximum of three. This tectonic shift in procurement behavior directly explains why strategic buyers are pursuing large platform acquisitions—they’re buying tools that CISOs actually want to consolidate into.

The Shift from “Buying Growth” to “Buying Cash Flow”

For years—particularly during the 2022-2024 period—strategic and venture capital buyers pursued high-growth startups, often accepting unprofitable targets in exchange for 50+ percent annual growth rates. That era has ended.

According to CONTEXT’s 2025 analysis, “the market moved from ‘buying growth’ in prior years to ‘buying cash flow’ and platform density in 2025”. Why the shift? Multiple factors converge: elevated interest rates have increased the cost of financing unprofitable growth; the IPO window remains largely shut, making acquisition the primary exit route for cybersecurity startups; and mature, profitable targets with predictable revenue streams deliver immediate accretion to acquirer earnings. Buyers now prefer vendors with established customer bases, positive unit economics, and path to profitability.

AI as the New Competitive Differentiator

Artificial intelligence has emerged as the decisive battleground in cybersecurity. But not just for defending against attacks—also for securing AI itself.

This dual imperative is driving a wave of smaller acquisitions by security leaders seeking to stay current with AI-driven threat expansion:

- Check Point acquired Lakera for $300 million to deliver an “end-to-end AI security stack” protecting enterprises adopting generative AI

- F5 bought CalypsoAI for $180 million to add real-time protection against prompt injection and jailbreaking attacks

- SentinelOne acquired Prompt Security for $180 million to provide visibility and governance over GenAI tool usage

- Zscaler purchased Red Canary for $675 million to combine threat hunting with an emerging next-generation SIEM alternative

- Accenture acquired CyberCX for $650 million, expanding its managed security services capability

- Atlassian Acquires Arc Browser Maker for $610M in AI Push

These transactions reveal a critical insight: major security vendors cannot innovate fast enough to keep pace with AI-driven attack surface expansion. Strategic acquisition has become the faster path to capability completeness.

Private Equity’s Ascendancy

A second M&A trend emerged in 2025: private equity firms increasingly taking cybersecurity companies private. Unlike strategic M&A—where buyers seek product integration and customer consolidation—PE acquisitions focus on operational improvement and cash flow optimization.

The SolarWinds transaction exemplifies this trend. After years of public market struggles and activist investor pressure, Turn/River Capital’s $4.4 billion acquisition allowed SolarWinds to focus on cash flow and operational improvement away from quarterly earnings pressure. This signals PE’s confidence that mature, profitable cybersecurity platforms remain valuable even without growth-at-all-costs dynamics.

The Quarterly Tempo: Consistent Deal Activity Throughout 2025

Deal flow remained remarkably consistent throughout 2025, signaling steady investor appetite rather than speculative booms. Q1 saw 96 transactions, Q2 ramped to 114 deals, and Q3 maintained steady pace at 111 deals. This quarterly consistency—despite major deal announcements dominating headlines—indicates that beneath the mega-deals lies a robust market for smaller transactions in the $100 million to $500 million range.

The quarterly breakdown also reveals an important pattern: mega-deal announcements did not suppress smaller M&A activity. Even as Google announced the Wiz deal, Check Point, F5, SentinelOne, Zscaler, and others continued acquisition activity. This suggests multiple concurrent capital sources pursuing different strategies rather than a single consolidation wave.

Strategic Themes Driving 2025 Acquisitions

The diversity of 2025 M&A activity reveals five converging strategic imperatives reshaping cybersecurity:

1. Identity as the AI Control Plane

With enterprises deploying AI agents, LLMs, and autonomous systems, the traditional perimeter has dissolved. Human and machine identities have become the critical control point. Palo Alto’s CyberArk acquisition, ServiceNow’s Veza purchase, and Okta’s acquisition of Axiom (for privileged access management) all target this same strategic thesis.

2. Multi-Cloud Visibility

Enterprises no longer pick a single cloud provider. They run AWS, Azure, and GCP simultaneously. Google’s Wiz acquisition directly addresses this reality—Wiz’s ability to scan virtual machines and containers across multi-cloud environments fills a critical gap in Google Cloud’s native security portfolio.

3. Operational Technology Security

Mitsubishi Electric’s $900 million to $1 billion acquisition of Nozomi Networks—the largest OT security deal on record—reflects growing recognition that industrial control systems and critical infrastructure represent high-value targets for state-sponsored and financially motivated threat actors.

4. Data Security Posture Management (DSPM)

Veeam’s $1.725 billion acquisition of Securiti AI combines data resilience with governance and privacy capabilities—addressing enterprise demand for unified data protection and compliance.

5. GenAI Security and Governance

Multiple acquisitions of smaller AI security startups (Lakera, CalypsoAI, Prompt Security) by larger platforms indicate broad recognition that traditional security tools cannot adequately govern the attack surface created by generative AI adoption.

The Implications for Enterprises

What does the 2025 M&A wave mean for organizations buying cybersecurity?

Reduced Complexity: As vendors consolidate and CISOs demand fewer tools, organizations will benefit from simplified management, better integration, and clearer accountability. The industry is responding to legitimate pain points.

Faster Innovation in AI Security: Strategic acquisition allows major platforms to rapidly acquire AI security capabilities rather than building from scratch. This should accelerate time-to-market for AI governance and threat detection tools.

Platform Lock-In Risk: As security consolidates around fewer platforms, organizations must carefully evaluate switching costs and contract terms. The flexibility to exit relationships or mix-and-match best-of-breed solutions in specific areas may decrease.

Talent Transitions: Major acquisitions create disruption and uncertainty among security professionals supporting those technologies. Organizations should prepare for potential talent attrition during and after consolidation.

Looking Ahead: What Consolidation Means for 2026

Industry experts anticipate that cybersecurity M&A activity will remain elevated in 2026—potentially even accelerate. Several structural factors support this outlook:

Abundant Capital: With more than $9.4 billion in first-half 2025 VC funding and substantial uninvested PE capital, acquisition capital remains plentiful.

Persistent IPO Challenges: The weak public market for tech IPOs ensures that acquisition will remain the primary exit route for venture-backed cybersecurity firms. This supplies a continuous deal pipeline.

Regulatory-Driven M&A: A novel trend emerging in 2026 will be “sovereign M&A”—U.S.-based vendors acquiring European-native firms specifically to gain EU-compliant infrastructure satisfying NIS2 and the Cyber Resilience Act requirements. Regulatory compliance is becoming a driver of acquisition strategy, not just security capability.

Consolidation Opportunities: With more than 5,000 cybersecurity vendors globally, the industry remains highly fragmented. Leaders estimate that further consolidation can continue for years.

Conclusion

The $84 billion cybersecurity M&A boom of 2025 represents more than a financial milestone. It signals fundamental realignment in how enterprises buy security and how vendors compete. The era of accumulating point solutions has given way to platform consolidation. The era of buying unprofitable growth has yielded to buying profitable cash flow. And the era of defending static perimeters has evolved into securing AI, cloud, identity, and critical infrastructure simultaneously.

The eight mega-deals—led by Google’s historic Wiz acquisition and Palo Alto’s strategic CyberArk purchase—will reshape cybersecurity competition for years to come. Smaller firms that don’t consolidate will face increasing pressure. Platforms that achieve critical mass in cloud security, identity governance, and AI protection will command premium valuations. And enterprises that navigate this consolidation wave strategically will emerge with simpler, more effective security architectures.

The cybersecurity industry’s maturation is evident in its deal making patterns. 2025 was the year consolidation accelerated from trend to standard practice. 2026 will be the year enterprises begin reaping the benefits—and grappling with the challenges—of that consolidation.